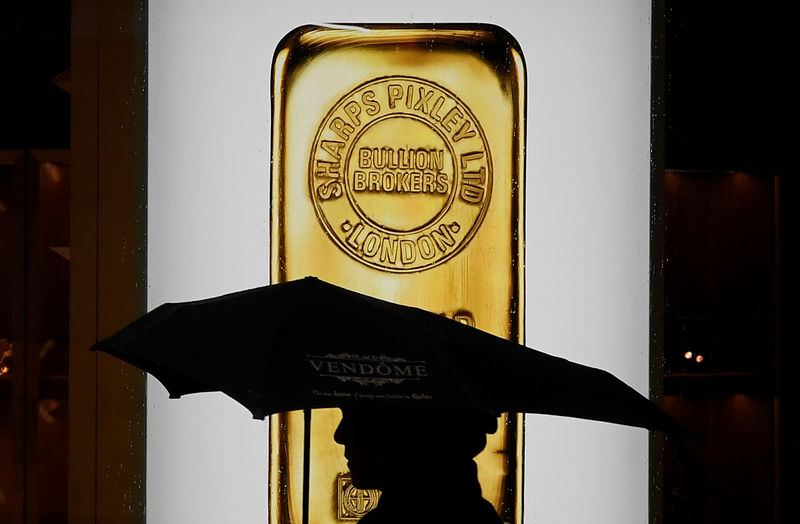

Gold Down as Global Optimism Continues

Gold was down on Monday morning in Asia as investors are look toward a brighter future. While stocks have had a roaring November, gold is facing its worst month in four years.

Gold futures were down 0.81% at $1,773.70 by 12:01 PM ET (4:01 AM GMT). Gold rolled over to the Feb 21 contract on Nov 29.

With expectations of an end to the COVID-19 pandemic rising as vaccines reach the final approval stage and the U.S. Federal Reserve looking likely to step up fiscal relief, investors are heading for risk-on stocks. Global markets have hit record heights in November, and gold is feeling the pressure, dropping 5.1% over the month. Fed Chairman Jerome Powell is due to testify before Congress on Tuesday and Wednesday.

After nearly a year of markets looking to safe-haven assets due to the ongoing economic and social curtailment of the COVID-19 pandemic, risk-on investing has returned in a big way. Gold fell through the $1,800 mark on Friday and continued lower on Monday morning.

On the COVID-19 front, U.S. health authorities are looking to roll out a vaccine for healthcare professionals and people in long-term care facilities, marking the beginning of an overall vaccination program. The U.K. is in the process of approving the Pfizer vaccine as well.

In further negative news for the precious metal, the E.U. and U.K. have restarted face-to-face meetings to iron out a post-Brexit trade agreement before the current arrangement expires on Dec 31. The negotiations have been stalled for some time, with the coronavirus epidemic also causing difficulties as negotiators were forced to quarantine.

In further U.S. news, outgoing President Donald Trump appears to be coming to terms with his electoral defeat. Trump’s legal efforts to have the results of the election overturned in his favor have failed to date, and his options forward are increasingly limited. He has agreed to accept the decision of the Electoral College when it delivers its results on Dec. 14. The added certainty has also pushed gold values down.